How Predictive Analytics is Shaping the Underwriting Process from Ohio

Underwriting, defined as the process where an insurer or financial institution extends coverage, credit, or loans to a person or a company for a fee or premium, is thought to have originated in the 1750s with Lloyds of London insuring maritime shipments. Over the years, companies providing underwriting like Lloyds would experience high profits as well as big losses due to the unpredictability of the medium. 270 years later, underwriting as a process looks very different with the ability for insurers to apply predictive analytics by using data science and technology. (Not that that could have helped Lloyds predict the coming American Revolution or the Napoleonic Wars…)

The addition of predictive analytics to the underwriting process is not transformational, but incremental. It allows underwriters to focus on the subjective items that require human judgment and intuition, while allowing the system to handle administrative items that would otherwise reduce human efficiency.

Underwriting has traditionally lived in the “art” and “science” world, requiring insights from historical trends and manual assessments of individual circumstances. As more and more underwriting departments and companies are looking for efficiency and process enhancements, predictive analytics can serve to solve some of these modern pain points.

Nearly 9 in 10 financial services companies have or are exploring the use of big data analytics to streamline automated underwriting processes.

Will underwriting be automated?

According to a 2013 Oxford University publication entitled, “The Future of Employment: How susceptible are jobs to computerisation?” it is estimated that around 47% of jobs will be automated in the future. This publication goes on to define the likelihood of automation for several occupations, ranking the job of underwriter as 698 out of 702, with the lowest numbered jobs being the least likely of being automated and the highest numbers being the most likely.

The truth is that the 2013 estimation has proven to be true with many companies reducing the number of underwriters on staff due to the groundbreaking advancements in automated underwriting processes. Manual underwriting processes take more time and are susceptible to human error. While manual underwriting is preferable for situations where someone requesting a loan or insurance have now resolved past financial issues or other risky behaviors, relying predominately on human underwriters is a bit of a drain on resources for providers these days. And consumers have grown increasingly accustomed to the benefits of automation in underwriting, namely when retrieving quick quotes on property insurance like car, home, and renters insurance.

In answer to the question ‘will underwriting be automated?’ the answer is likely ‘not entirely.’ While it’s true that the bulk of the data used to determine risk for loans and insurance coverage is quantitative, and therefore ideal for algorithms, underwriters are still needed to set the parameters for the risk assessment, evaluate the automated underwriting results to ensure accuracy, as well as take on the more challenging tasks that require human reasoning. It’s most likely that financial institutions and insurers will find the most value in underwriters and automated underwriting processes continuing to work hand-in-hand to save time and avoid errors.

![]()

What is automated underwriting and how does it work?

Automated underwriting is a process combining the benefits of advanced technologies like robotic process automation, artificial intelligence, and machine learning to underwrite for financial institutions or insurance companies. When client data is input, predictive analytics are applied to assess the risk of a particular individual or company based on historical data. After all, with predictive analytics the goal is to discover with the best of statistical probability what will happen in the future.

It’s no secret that automated underwriting processes are here to stay, so the companies currently leveraging the advances in technology to automate underwriting while providing individualized results are likely going to outperform (or continue to outperform) their more traditional competitors. In fact, when it comes to insurance, Business Insider found that 55% of tech-savvy and 43% of non tech-savvy insurance customers would consider personalized products and services as a reason to stay with an insurer.

What does personalization look like in automated underwriting?

For a great example of personalization in automated underwriting, we need look no further than Root Insurance Company, headquartered in Columbus, Ohio. Root’s unique approach to car insurance underwriting uses a system that assesses each person’s individual driving behavior, giving a truly personalized rate and coverage. In addition, the automated underwriting system will keep checking for safer driving habits, updating a person’s insurance policy to lower their price if they develop better, less risky behaviors.

“Proprietary data and machine learning are enabling us to build a better business and contribute to building a better and fairer world. Whether relying on credit scores, education history, or occupation, it’s an open secret that the variables used in pricing auto insurance today disproportionately and unfairly impact those who can least afford insurance, perpetuating a vicious cycle of financial hardship. Root is committed to addressing this unfairness by empowering consumers and leveling the playing field.

“Every piece of data improves our pricing ability. Every customer who uses our app or website delivers valuable insights to make our interfaces better for the next customer. Ours is not the typical insurance industry mindset. We believe that by continuing to disrupt and focusing on the long term, Root will become the industry-defining platform, built to last.”

Ohio is a hub for fintech and insurtech innovation

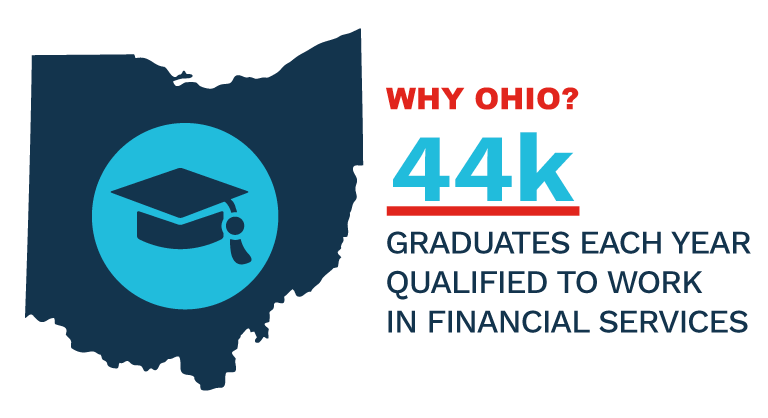

It’s no surprise that some of the most revolutionary fintech and insurtech companies in the industry are located right here in Ohio. Fast-growing insurtech companies like Root, Branch, and Beam use data science within their platforms and need the kind of abundant IT talent pipeline Ohio offers to staff their headquarters. Established leaders in the financial services industry such as KeyBank and Fifth Third Bank as well as the insurance industry such as Progressive and Nationwide rely on the plentiful talent with a wide range of skills supplied by Ohio’s nationally recognized universities. In fact, these universities graduate around 40,000 college graduates who are qualified to work in financial services.

Any organization looking for where to locate their headquarters will be in great company in Ohio. The state has the fifth largest financial services sector in the U.S. as well as being third in the top 50 bank and insurance headquarters by assets. Plus, a move to Ohio offers cost savings over the more expensive coasts. Ohio’s qualified talent costs 11.5% less than the national average, while lower rent and cheaper office space makes every dollar saved available for research and development.

And speaking of R&D, JobsOhio’s Research & Development Center Grant is available to help fintech and insurtech companies pursuing innovations in these industries. Throw in a supportive business and regulatory climate and it’s easy to see why Ohio is the choice of so many established leaders and startups in fintech and insurtech.

While underwriting at one time was an incredibly nuanced and complex aspect of financial and insurance companies, automation and predictive analytics have made it possible for companies to streamline operations while maximizing profitability. Want to see how your fintech or insurtech business can grow in Ohio? We’re here to discuss any of your questions. Contact us today for more information.