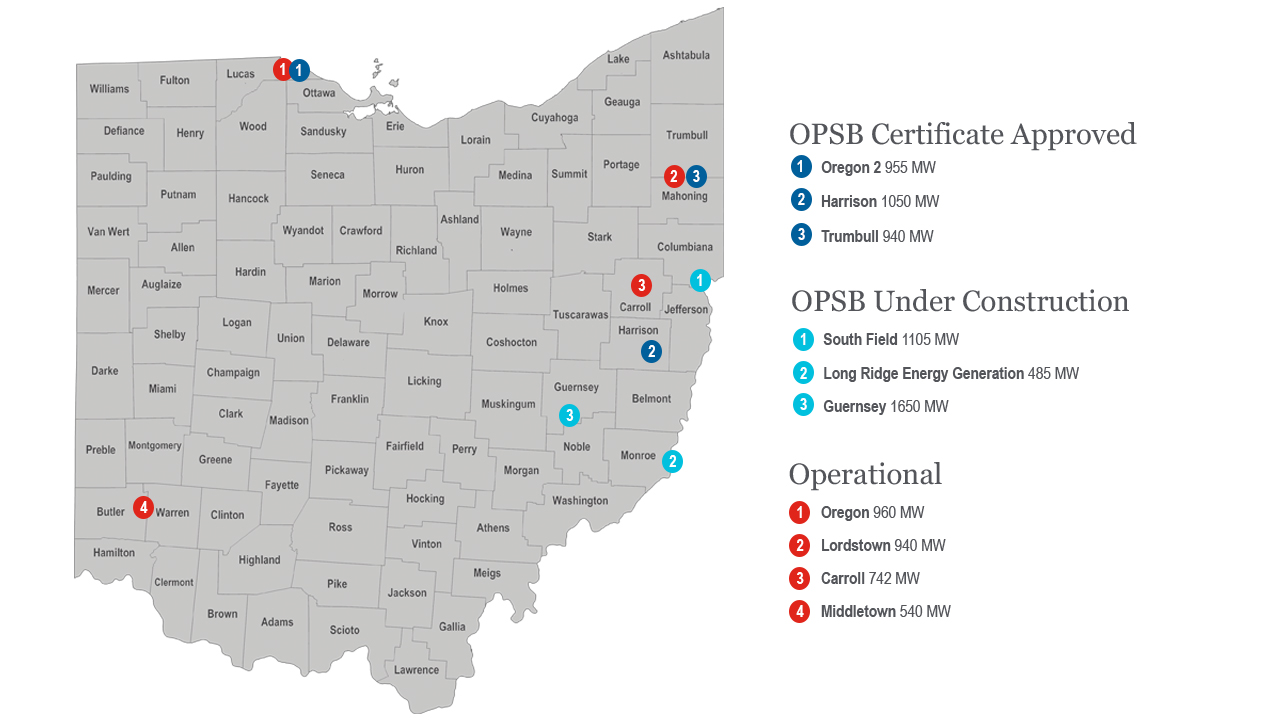

Ohio's Shale Investment Report

Operating and In-Development Gas-Fired Power Plants in Ohio through August 2019

Ohio’s shale gas industry continues to lead the nation in growth for the fourth consecutive year due to the presence of the massive Utica and Marcellus shale deposits.

To independently track the industry’s impact on the state of Ohio in an unbiased manor, JobsOhio has enlisted the help of Cleveland State University’s Maxine Goodman Levin College of Urban Affairs to put together the Shale Investment Dashboard in Ohio.

Using actual investment data provided directly by shale companies deploying the capital, the report examines upstream, midstream and downstream portions of the industry. First launched in 2016, the report is updated on a quarterly basis as additional information becomes available on cumulative investments made in Ohio.

Insight from JobsOhio Director of Energy and Chemicals

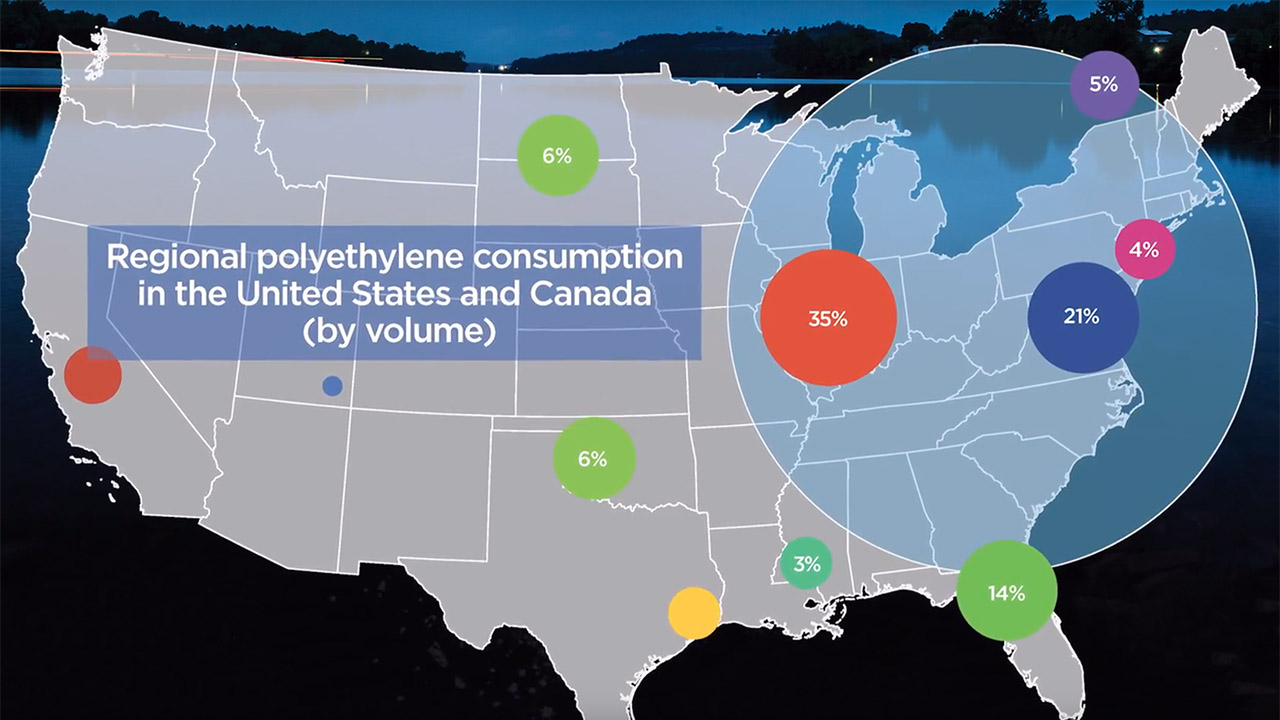

“The abundant natural gas liquids and further buildout of transportation assets are driving the growth of Ohio’s energy and chemicals industry. Abundant and low-cost natural gas, butane, ethane, propane and condensate are catching the attention of manufacturers and chemical producers who value low-cost feedstocks, proximity to over 60 percent of the U.S. marketplace and Ohio’s business friendly environment. Vast shale resources are attracting many energy investments – from upstream extractors and fractionators/processors to downstream power generators and complex chemicals companies. We believe it is important to track these developments and share the findings with companies currently in Ohio and those looking to invest in Ohio.”

-Matt Cybulski, director of energy and chemicals, JobsOhio

The Shale Crescent: The New Leader for Energy Investments

For many years, the Gulf Coast has been the No. 1 location for energy-intensive companies, but things have changed. Companies that locate in the Shale Crescent region, which includes Ohio, West Virginia and Pennsylvania, generate a net present value four times higher than that of the Gulf Coast. Companies have the advantage of market access, a stable workforce, plentiful natural gas and abundant water. Trusted resource IHS Markit has compared projects in the Shale Crescent region to projects in other locations and verified they bring about greater savings and profits. Look no further for your company’s next move than the Shale Crescent.

Quarterly Reports

Current and past Shale Investment Dashboard in Ohio reports are contained below.

- Shale Investment Dashboard in Ohio Q1 and Q2 2020

- Shale Investment Dashboard in Ohio Q3 and Q4 2019

- Shale Investment Dashboard in Ohio Q1 and Q2 2019

- Shale Investment Dashboard in Ohio Q3 and Q4 2018

- Shale Investment Dashboard in Ohio Q1 and Q2 2018

- Shale Investment Dashboard in Ohio Q3 and Q4 2017

- Shale Investment Dashboard in Ohio Q1 and Q2 2017

- Shale Investment Dashboard in Ohio Q3 and Q4 2016